For many Australians, the First Home Super Saver Scheme has emerged as a strategic initiative to attract more people to the property market. The FHSS Scheme offers a unique opportunity to save for a home more efficiently. However, successful navigation of the scheme requires careful planning and consideration of individual circumstances.

Table of Contents

What is the First Home Buyer Super Saver Scheme?

The “First Home Super Saver” scheme (FHSS) is a new initiative by the Australian government to help first-time home buyers save for their home deposit through the superannuation system.

Here’s how it works:

- Voluntary Contributions: You can save for your home deposit by making voluntary contributions to your superannuation fund.

- Withdrawal for Property Purchase: When you’re ready to buy your first property, you can withdraw up to $15,000 from your voluntary contributions in a financial year under the FHSS scheme.

- Cumulative Limit: The total limit for contributions over all years is $50,000. If you requested a release before July 1, 2022, when the limit was $30,000, you can’t make additional requests to reach the current $50,000 limit.

- Associated Earnings: Upon release, you’ll receive associated earnings based on the shortfall interest charge (SIC) rate. Note that these earnings are “deemed”, meaning they don’t represent the actual earnings in your fund.

- Versatile Use: The funds released through the FHSS scheme can be used for buying both new and existing homes in Australia. This flexibility allows you to navigate the real estate market based on your preferences and needs.

Benefits of the FHSSS

The FHSSS offers a multitude of benefits for aspiring homeowners, empowering them to accelerate their deposit savings and achieve their dream of owning a home. Here are some of the key advantages:

Tax Advantages:

- Reduced Tax Rate: Concessional contributions within your super are taxed at a flat rate of 15%, significantly lower than most individuals’ marginal tax rates.

- Tax Offsets: Utilize tax offsets like the Low Income Superannuation Contribution (LISC) to receive additional government co-contributions, further boosting your savings.

- Tax-Free Growth: Contributions within your super grow tax-free until withdrawal, allowing your savings to compound and accumulate more wealth over time.

Increased Savings Potential:

- Direct Contribution: Utilise voluntary contributions to build your deposit faster, allowing you to enter the property market sooner.

- Salary Sacrifice: Redirect a portion of your pre-tax salary directly into your super, maximising your savings and reducing your taxable income.

- Release of Eligible Contributions: Withdraw up to $50,000 of your eligible voluntary contributions (including earnings) to contribute towards your first home deposit.

Flexibility and Control:

- Gradual Savings: Build your deposit over time with regular contributions, allowing you to tailor your savings plan to your budget.

- Investment Options: Choose suitable investment options within your super fund to align with your risk tolerance and investment timeline.

- Control over Withdrawal: You have control over when to withdraw your eligible contributions, allowing you to optimise your timing for the property purchase.

Additional Advantages:

- Reduces Reliance on Debt: By increasing your deposit through the First Home Super Saver Scheme, you can potentially reduce your reliance on loans and associated interest payments.

- Boosts Affordability: A larger deposit can enhance your borrowing power, allowing you to purchase a more desirable property.

- Promotes Financial Security: Saving for a home early instils responsible financial habits and contributes to long-term financial security.

The First Home Super Saver Scheme (FHSSS) can be a game-changer for first-home buyers, offering a powerful tool to boost savings, minimise tax burden, and take control of your homeownership journey. But before diving in, here are 5 essential things you need to know:

First Home Super Save Scheme: 3 Things You Need to Know

1. Eligibility and Conditions

You must meet specific criteria to be eligible to utilise your super for purchasing a home under the First Home Super Saver Scheme (FHSSS).

To be eligible for the First Home Super Saver Scheme, you must:

- Be at least 18 years old

- Have never owned property in Australia, including investment properties and vacant land (unless you’ve experienced financial hardship)

- Not previously requested for your super to be released under the scheme

Also, after acquiring your property, you must reside in it as promptly as feasible.

Furthermore, you must ensure that you live in the said property for at least six consecutive months within the initial year of ownership.

The application process is straightforward. To apply, you need to request a First Home Super Saver Scheme determination from the Australian Taxation Office (ATO) via the myGov website. This determination will show the maximum amount you can release.

Regularly checking the Australian Taxation Office (ATO) website or consulting with a financial advisor can provide updated information on income thresholds and other eligibility criteria.

The co-contribution initiative is a valuable opportunity for those who qualify, offering a boost to their superannuation savings with minimal effort.

This step is vital to ensure that you are compliant and eligible to withdraw the funds under the scheme.

Source: Mozo

3. Eligible contributions

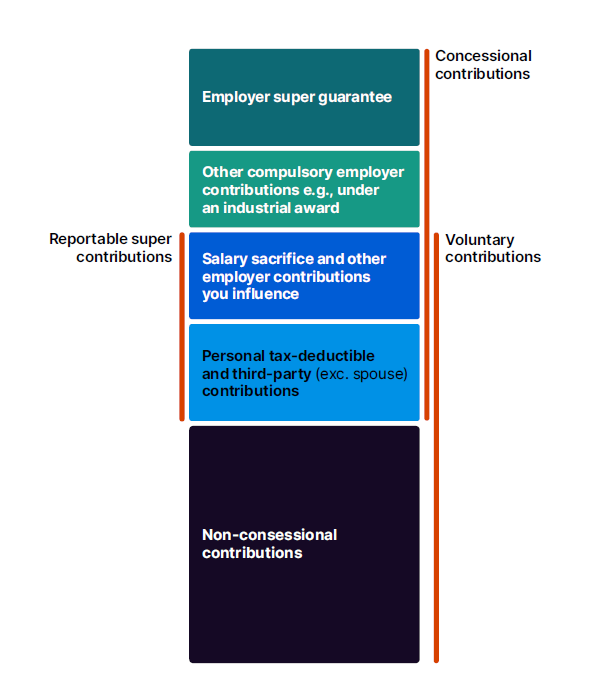

You can make the following types of contributions under the FHSS scheme:

- voluntary concessional contributions – including salary sacrifice amounts or contributions you have claimed or intend to claim a tax deduction for (usually taxed at 15% in your fund)

- voluntary non-concessional contributions – including personal after-tax contributions (where you haven’t claimed a tax deduction).

Only contributions made from 1 July 2017 are eligible for release under the FHSS scheme.

Source: ATO

You can contribute up to the limit allowed in your current super contribution caps. Using the FHSS scheme doesn’t impact how your concessional or non-concessional contributions are calculated for the contribution caps. Your contributions still count toward the caps in the year you initially made them.

You can apply for the release of up to $15,000 of your voluntary contributions from any one financial year, up to a total of $50,000 contributions across all years. You must include eligible contributions for all years in the same determination application.

You can check your eligible contributions with your super fund(s) at any time to see how much you have saved. This will help you keep track of the maximum FHSS amounts you can have released.

Before commencing savings, it is advisable to:

- Confirm that your nominated super fund(s) will facilitate the release of funds.

- Inquire with your fund about applicable fees, charges, and insurance implications.

- Verify that your super fund has accurate contact details matching the records held by relevant authorities.

- Be aware that receiving First Home Super Saver Scheme amounts will impact your tax for the requesting year, requiring the inclusion of assessable and tax-withheld amounts in your tax return.

No notification to your employer, super fund, or the Australian Taxation Office (ATO) is necessary before making contributions for FHSSS purposes.

These contributions are not segregated within your super account(s) and are not obligated for use under the FHSS scheme. If unused, they remain part of your super interest.

For those considering the financial hardship provision, it is advisable to determine the provision’s applicability before commencing savings.

3. Pros and Cons of the First Home Super Saver Scheme

Before delving into the First Home Super Saver Scheme (FHSSS), it’s crucial to weigh the various advantages and disadvantages.

Pros

- Using this scheme could potentially help you save up for your first home deposit more quickly.

- You can pay less in taxes by opting for the lower super tax rate of 15%, rather than your regular income tax, which could go as high as 45%.

- However, keep in mind to consider the taxes you’ll need to pay when you decide to withdraw the money.

Cons

- The scheme can be complex.

- The maximum amount you can save is $50,000, so it can cover all or part of your house deposit.

- You can contribute up to $15,000 per year, meaning careful planning is essential to maximise the scheme’s benefits.

- If you choose not to purchase a house, you have two options: keep the money in your super, or withdraw it and face taxation.

Wrap up

The First Home Super Saver Scheme (FHSSS) presents a valuable opportunity for aspiring homeowners in Australia to boost their deposit savings and accelerate their journey towards property ownership.

By offering tax advantages, increased savings potential, and flexibility, the FHSS empowers individuals to gain greater control over their financial future.

However, navigating the scheme effectively requires careful planning and a thorough understanding of its eligibility requirements, contribution options, and potential implications.

By considering the benefits and drawbacks, understanding circumstances, and seeking professional guidance where needed, you can make informed decisions and leverage the FHSSS to unlock your homeownership aspirations.

Contact our team of experts today to unlock the benefit of the First Home Super Saver Scheme.