Buying your first home is an exciting milestone, but it can also be a complex process. Understanding the ins and outs of the real estate contract for sale is crucial for first-time buyers. In this article, we’ll delve into the key aspects of the real estate contract and shed light on how it works for those venturing into homeownership for the first time.

Table of Contents

Real Estate Agent & Property Consultant Guidance

One of the first steps in purchasing a home is enlisting the services of a real estate agent or property consultant. These professionals play a vital role in connecting buyers with suitable properties and guiding them through the entire transaction. The real estate agent or property consultant assists in negotiating the purchase price, drafting the contract of sale, and navigating the intricacies of the homebuying process.

The agent or consultant’s local and wider market knowledge is invaluable in ensuring buyers make informed decisions about their purchase.

The Contract of Sale

The contract of sale is a legally binding document that outlines the terms, conditions and key details of the property transaction.

It includes essential details such as:

- Names of the buyer and seller

- Agreed purchase price

- Deposit payable

- Any special conditions

- The settlement date

First home buyers should carefully review the contract of sale. Legal advice is recommended to ensure a comprehensive understanding of contractual obligations.

Legal professionals such as solicitors and conveyancers can help first home buyers navigate the complexities of the contract of sale, ensure they are legally compliant with obligations and minimise any risk of legal issues.

Understanding the Purchase Price

The cornerstone of any real estate transaction is the purchase price. This is the amount agreed upon by the buyer and the seller for the property.

Striking a balance between affordability and market value is crucial for first home buyers. It’s crucial to conduct thorough research on property values in their desired area, helping buyers avoid overpaying for a property. A balanced approach ensures a reasonable offer that aligns with both financial capacity and market conditions.

The negotiation process, facilitated by the agent or consultant, aims to arrive at a mutually acceptable purchase price that reflects the market value of the property.

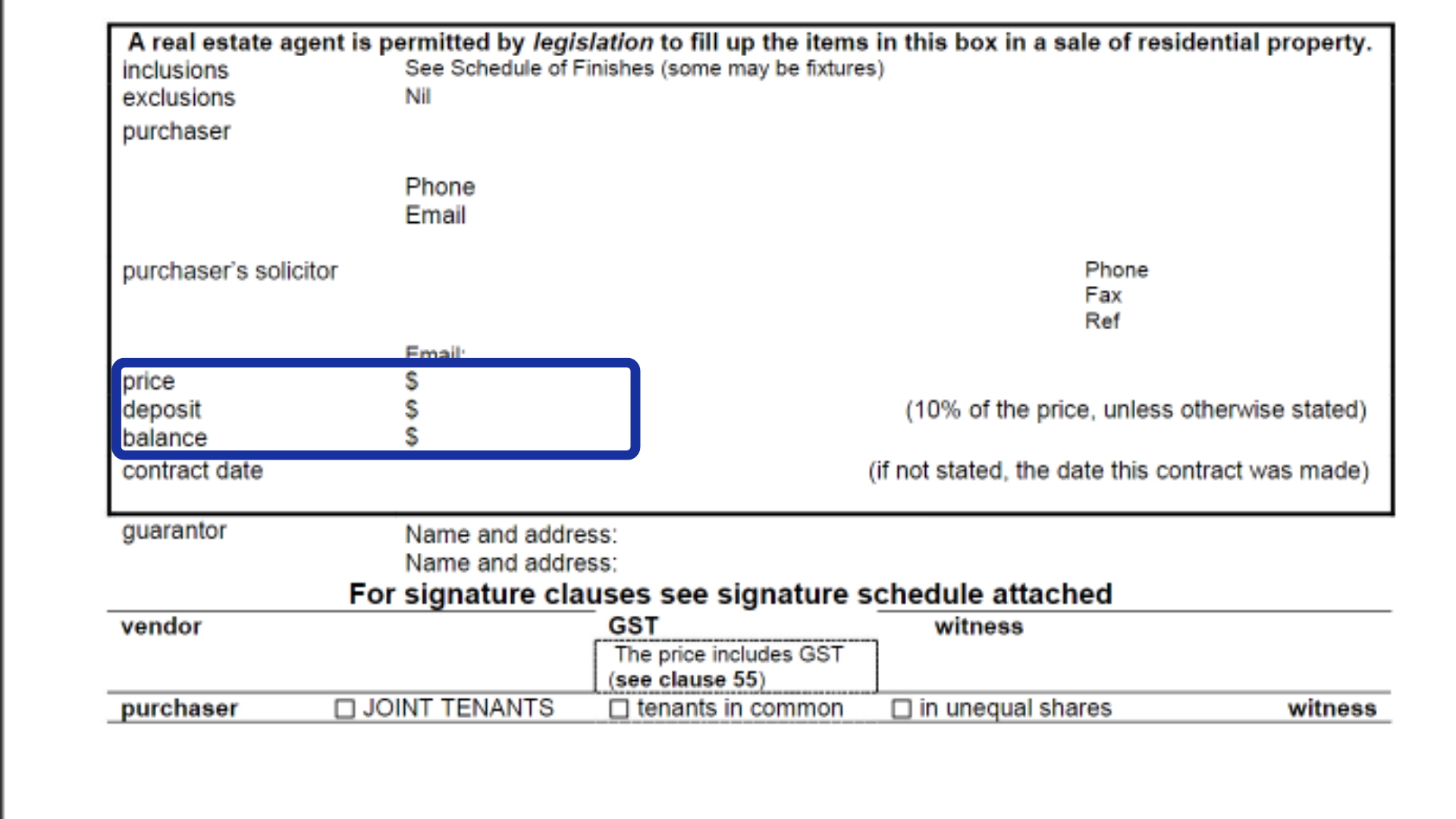

The Purchase price will be written on the front page of the signed real estate contract of sale, as highlighted below.

Cooling Off Period

In many real estate transactions, a cooling off period is incorporated into the contract of sale. This is a specified timeframe during which the buyer can withdraw from the contract without facing significant penalties.

The cooling off period provides first home buyers with an opportunity to conduct additional inspections, obtain finance, organise an independent property valuation and address any concerns that may arise after the initial offer.

During the cooling off period, buyers may also choose to engage professional inspectors to assess the property’s condition thoroughly. This step is crucial for identifying any potential issues that may affect the decision to proceed with the purchase.

What happens if I choose to withdraw from a contract of sale?

If the buyer decides to withdraw from the contract within the cooling off period, a nominal fee may be incurred, but this is a small price to pay for the assurance of making an informed decision.

What should I be aware of with a Cooling Off Period ?

It’s essential to be aware that the cooling off period varies between states and territories, so buyers should familiarise themselves with the local regulations.

Vacant Possession

Vacant possession, a pivotal aspect of a real estate contract for sale, signifies the property will be handed over to the buyer free of occupants or tenants. This condition is crucial for a seamless transition, allowing the new homeowner to take immediate possession of the property.

There are a number of typical subclauses in a contract of sale regarding vacant possession:

- Clean and Free of Debris:

- Importance: The property should be presented in a clean and well-maintained state, free of debris or excessive clutter.

- Action: Buyers may insist on a clause specifying that the property will be handed over in a thoroughly cleaned condition, with the removal of any rubbish or debris, ensuring a welcoming environment upon possession.

- Unoccupied Spaces:

- Importance: Vacant possession implies that all spaces within the property are unoccupied, including storage areas and garages.

- Action: Subclauses may detail the requirement for all areas of the property to be vacated, ensuring the buyer receives full access to their new home.

Including these subclauses in the vacant possession condition helps to define the expectations for the property handover. Buyers should carefully review these subclauses in the contract of sale to ensure that the property meets their standards for cleanliness and readiness for immediate occupancy.

Sunset Clause

A sunset clause is a vital component of a real estate contract for sale, placing an expiry date or time limit on its validity. This clause is particularly significant in off-the-plan apartment purchases but extends to various property transactions.

Who does a Sunset Clause protect?

A Sunset Clause is designed to protect both the buyer and the seller. It serves as a mechanism to prevent indefinite delays in the settlement process, ensuring that the property transaction reaches its conclusion within a reasonable timeframe.

What happens if the Sunset Date is reached?

In the context of off-the-plan purchases, the sunset date is a critical milestone. If settlement has not occurred by this specified date, both the buyer and the seller/vendor retain the legal right to walk away from the contract for sale. This provision prevents parties from being indefinitely bound to a property transaction that faces any unexpected delays in the completion or occupation approvals for the property, or even issues regarding finances.

For first-time home buyers, especially those considering off-the-plan apartments, paying close attention to the sunset clause is imperative. Diligent efforts to meet specified deadlines are essential to avoid potential complications. Understanding the impact of the sunset clause empowers buyers to navigate the complexities of real estate contracts confidently.

Settlement Period

The settlement period is the timeframe between the exchange of contracts and the actual transfer of property ownership. During this period, both parties fulfil their respective obligations outlined in the real estate contract of sale.

The settlement period is a pivotal phase for first-time home buyers. Effective communication with key professionals during this time ensures a seamless transition and marks the culmination of the homebuying journey.

Professionals to Stay in Contact with:

- Mortgage Brokers or Lenders:

- Importance: Handle financial aspects, secure loans for settlement.

- Action: Regular updates, address additional requirements promptly.

- Solicitors or Conveyancers:

- Importance: Ensure legal compliance, handle fund transfers.

- Action: Schedule updates, address legal queries promptly.

- Real Estate Agents or Property Consultants:

- Importance: Facilitate communication, coordinate property inspections.

- Action: Stay in touch for updates, coordinate tasks.

- Building and Pest Inspectors:

- Importance: Identify property issues, crucial for negotiations.

- Action: Attend inspections, discuss findings with professionals.

Why Staying in Touch Matters:

- Timely Problem Resolution: Identifying and resolving issues promptly.

- Coordination of Tasks: Synchronize inspections, legal reviews, and financial arrangements.

- Peace of Mind: Stay informed for confidence during the final stages.

Conclusion

In conclusion, the real estate contract for sale is a critical component of the homebuying journey for first-time buyers. Partnering with a reputable real estate agent, understanding the intricacies of the purchase price negotiation, carefully reviewing the contract of sale, and utilizing the cooling off period, vacant possession, sunset clause, and settlement period effectively are key steps in ensuring a smooth and successful home purchase. With the right guidance and knowledge, first home buyers can confidently navigate the real estate landscape and turn their homeownership dreams into reality.

Frequently Asked Questions

How do I buy my first home in Australia?

To buy your first home in Australia, follow these steps:

- Engage a real estate professional to help you find suitable properties.

- Secure financing through a mortgage broker or lender.

- Negotiate & confirm the purchase price with the seller.

- Review and sign the contract of sale.

- Conduct inspections during the cooling off period.

- Finalise financing and legal requirements.

- Settle the property ownership transfer.

What is a real estate contract for sale, and how does it work for first-time home buyers?

A real estate contract for sale is a legally binding document outlining the terms of a property transaction. For first-time home buyers, it includes details like the purchase price, buyer and seller information, special conditions, and the settlement date. Understanding and carefully navigating this contract is crucial for a successful home purchase.

What are the key components and terms typically found in a real estate contract for sale?

Key components of a real estate contract of sale include; the names of buyer and seller, the purchase price, key property details, special conditions, settlement date and the cooling off period.

Are there any specific considerations or differences in the real estate contract for sale process for first-time home buyers compared to experienced buyers?

First-time buyers may benefit from additional guidance including from legal professionals, and their contracts may include conditions to protect their interests, such as longer cooling off periods or financing contingencies. Experienced buyers may navigate contracts with more confidence but must still review terms carefully and should still engage legal professionals.

How does the negotiation phase factor into the real estate contract for sale for first-time home buyers?

Negotiations during the contract phase involve determining the purchase price, special conditions, and other terms. First-time buyers should rely on their real estate professional for guidance and be prepared to compromise to secure a fair deal.

What protections and rights does a real estate contract for sale provide to first-time home buyers?

The contract provides legal protections, outlining buyer and seller obligations. For first-time buyers, the cooling off period allows withdrawal without penalties, and thorough inspections protect against unforeseen issues.

Are there common pitfalls or mistakes that first-time home buyers should be aware of in relation to the contract for sale?

Pitfalls include rushing through the contract, neglecting inspections, and not seeking legal advice. First-time buyers should carefully review the contract, address concerns, and engage legal representation.

How does the financing contingency work in a real estate contract for first-time home buyers?

A financing contingency allows first-time buyers to withdraw from the contract if they can’t secure financing. This provision protects buyers from unforeseen financial challenges, but adherence to deadlines is crucial.