Table of Contents

RBA Update

At its meeting today, The RBA decided to increase the cash rate by 25 basis points to 4.10 per cent.

Reserve Bank governor Philip Lowe has made it clear inflation remains a problem and that more rate rises might be needed to address it.

“Inflation in Australia has passed its peak, but at 7 per cent is still too high and it will be some time yet before it is back in the target range.” He said

“This further increase in interest rates is to provide greater confidence that inflation will return to target within a reasonable timeframe.”

The labour market conditions are also affecting this decision:

- Labour market conditions have eased compared to the previous month but are still tight

- Labour shortages have decreased, but job vacancies and advertisements remain high

- Wages have increased due to tight labour markets and high inflation

- Public sector wages are expected to rise further

According to Phil O’Donoghue, the chief economist of Deutsche Bank, the economy has shown resilience to a rapid tightening cycle, and as a result, he believes that a cash rate of 4.6 percent is necessary.

“In light of … a stunning turnaround in the house-price cycle, an unemployment rate that could move sideways for at least six more months, and a minimum wage decision that leaves material upside risks to wage growth compared to the RBA’s current forecast of 4 per cent … we now expect that the RBA cash rate will reach a terminal rate of 4.6 per cent,” Mr O’Donoghue said.

Inflation is here to stay

Despite forecasts that inflation will peak early in 2023, there is still a fair bit of friction in current inflation that is intensified by supply chain shortages.

Wesfarmers chairman Michael Chaney predicts that more rate rises and years of inflation are ahead of us in the future. He believes that it will be difficult to get back down to the 2% level that the Federal Reserve and the Reserve Bank are aiming to reach.

“We all know why inflation has occurred. It’s supply chain shortages exacerbated by the situation in Ukraine. And recently we’ve had the oil producers saying they’re going to put a floor under that.”

“So I think it’s going to be a while until it comes down, and people generally think it’ll be 2025 until we are getting into much lower levels.”

Stamp Duty reduced

Last Tuesday, the new Minns Labor government in NSW passed new reforms on Stamp Duty in an effort to help first-home buyers with purchasing their first property.

Starting from 1 July, there are new rules regarding Stamp Duty exemptions for first-home buyers. Previously, the exemption applied to properties worth up to $650,000. However, this limit has now been increased to $800,000. In addition, properties valued between $800,000 and $1,000,000 will also be eligible for a concessional rate of Stamp Duty.

“I understand the stress of trying to buy your first home. I want more singles, couples and families realising this dream,” Premier Chris Minns said.

“Under Labor; any property purchased under $800,000 will have absolutely no Stamp Duty. And any property purchased up to $1,000,000 will have a reduced rate.”

First Home Buyer Choice (FHBC), which provided a land tax option, won’t be accessible after 1 July, 2023. Eligible first-home buyers who exchange contracts on or before 30 June 2023 will have until settlement to opt into FHBC.

Rental affordability is at its worst level yet

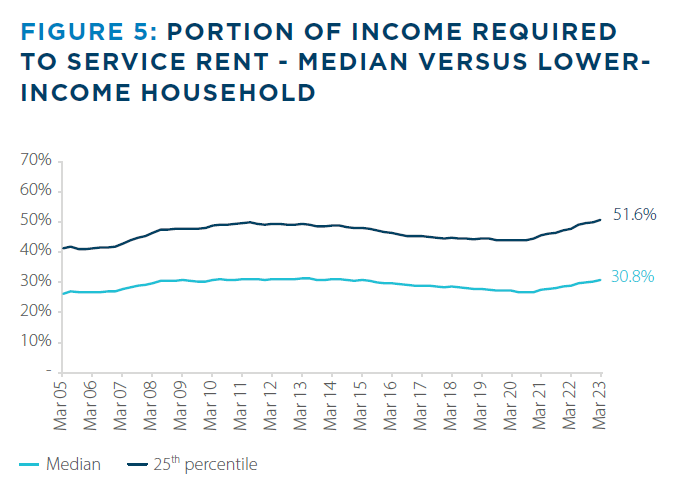

Research has shown that rental affordability – the proportion of income required to service a new lease – is at its highest national average since June 2014. According to ANZ CoreLogic Housing Affordability reports, 30.8% of an average income is required to service a new lease in Australia.

Source: CoreLogic, ANU

ANZ senior economist Felicity Emmett was unsurprised about the affordability figures due to the ongoing rental crisis but expressed concern about how more tenants in Australia will inevitably be forced into difficult living situations.

“For someone to be spending 50% of their income (25th percentile) on their rent means that there’s very little left over for anything else,” she said.

“It actually means these people on the 25th income percentile will really struggle to pay their rent and are likely to be forced to either live with more people and share the costs around, or perhaps try and seek out government supported housing, and some might have to turn to homelessness provisions.”

“Paired with a decline in social housing, rental demand pressures are being felt in all income brackets.”

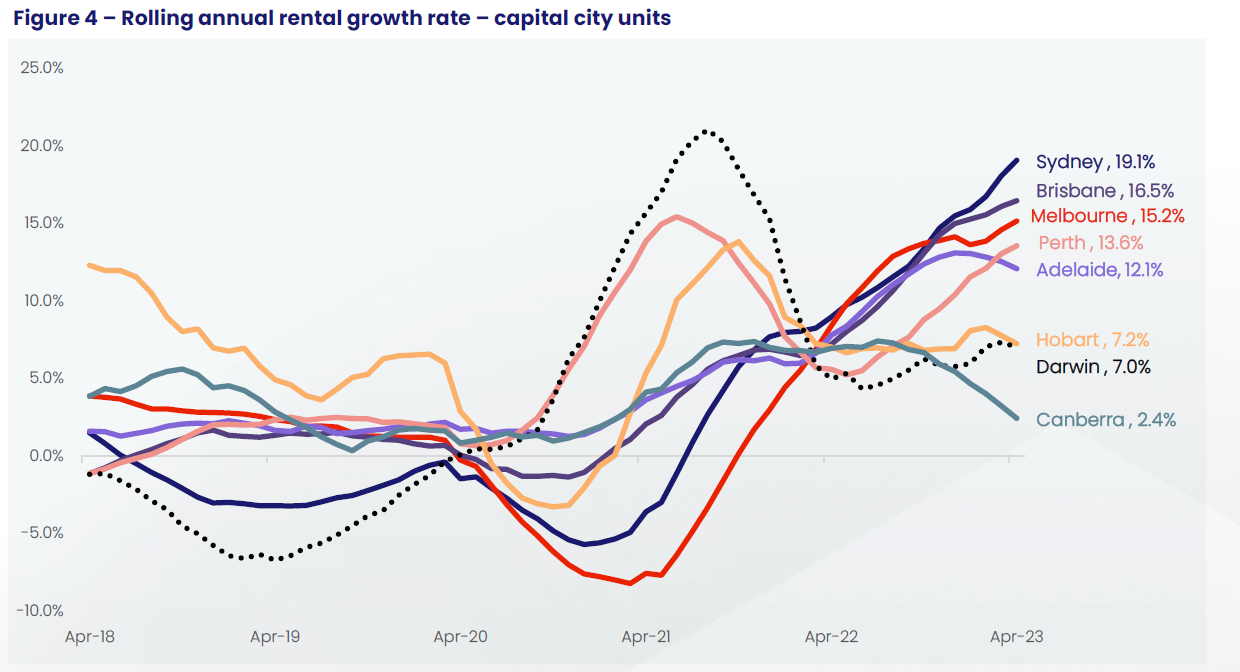

Strong demand for rental units in capital cities and a shortage of listings have narrowed the gap between median house and unit rents, according to CoreLogic.

Unit rents in capital cities have been growing faster than house rents, increasing by 1.6% in April compared to a 0.9% increase for houses.

Domestic factors such as the return of Australian students, worker rental demand in inner city areas, and the attraction of lower unit rental rates, along with the influx of overseas migrants and international students, have contributed to a record 4.9% increase in unit rents over the three months leading up to April.

This rising demand for rental units has resulted in a significant annual increase in the capital cities. In Sydney, there has been a new record high with a 19.1% surge. This translates to an additional $106 per week or nearly $5,500 more per year for renters in Sydney.

Source: CoreLogic

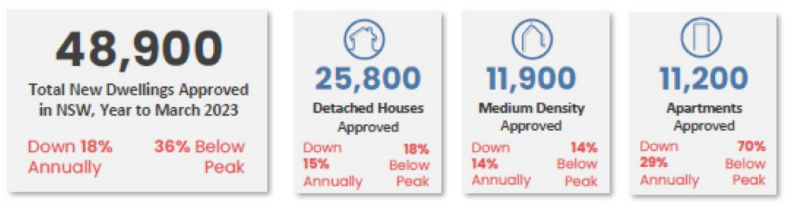

Data from the Urban Development Institute of Australia suggests that a large part of the rental crisis stems from the lack of housing supply, resulting in higher demand for rental properties and higher rental prices.This is indicated by the lowered rates of building approvals in NSW from the past financial year across all property types including detached housing, medium density and apartments.

Source: The Urban Development Institute of Australia

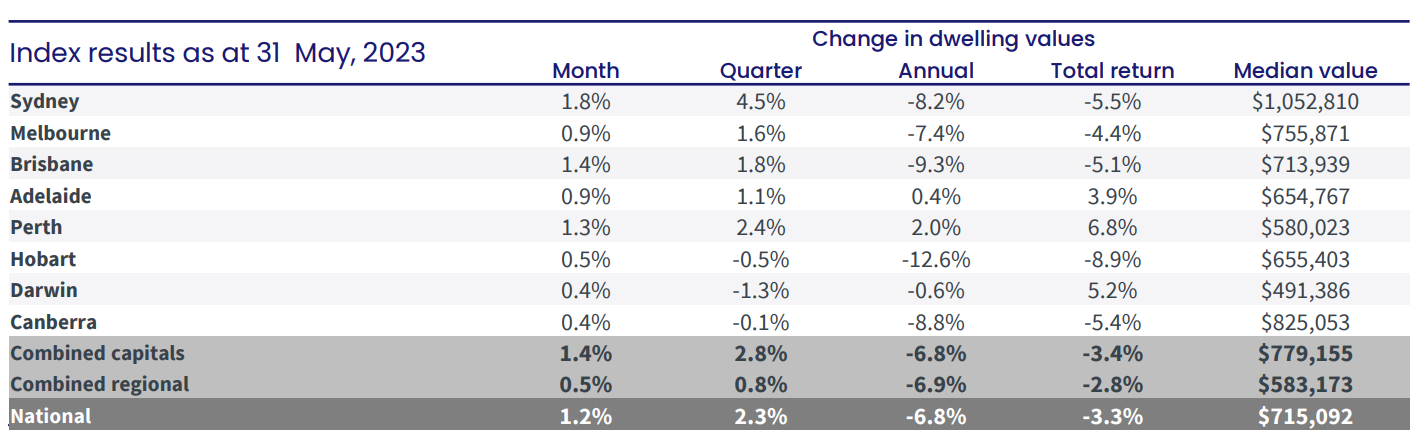

Home Value Index Shows Strong Resilience

Following an upward trend since last month, national home value surges with strongest monthly growth since November 2021 (Corelogic)

Leading the recovery trend, Sydney observed a significant surge of 1.8% in property values, marking the highest monthly gain for the city since September 2021. Since reaching a low point in January, home values have increased by 4.8%, which is equivalent to a substantial boost of $48,390 in the median dwelling value.

According to Tim Lawless, the Research Director at CoreLogic, the favourable pattern can be attributed to the ongoing scarcity of housing supply, which is being confronted with a growing demand for housing.

“With such a short supply of available housing stock, buyers are becoming more competitive and there’s an element of FOMO creeping into the market.”

Source: CoreLogic

With housing values moving through a third month of growth, it is clear the market has moved past a short but sharp downturn.

Higher Clearance Rate Trend

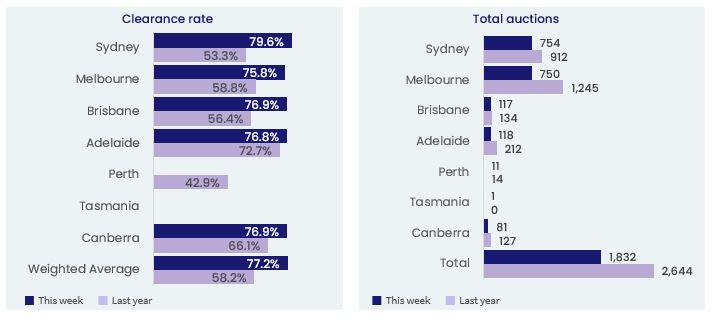

In good news, CoreLogic Australia reports this past week are demonstrating further momentum in auction markets with a preliminary clearance rate of 78.9%, the highest since early November 2021.

Sydney was the busiest auction market this week, with 754 homes auctioned across the city. Compared to the previous week (698), this week’s auction activity was up 8.0%.

All capital cities experienced a high clearance rate in the upper 70% range, much higher compared to this time last year.

Source: CoreLogic

To sum it up, this is what we can report in the property market this month:

- RBA increased the cash rate to 4.1%

- The Stamp Duty exemption and concession price cap for first home buyers have been expanded

- Rental affordability is now 30.8%, the highest national average since June 2014

- Inflation and rate rises are predicted to continue until 2025

- The home value growth rate of 1.2% across Australia, especially in the unit sector is good news for investors

What’s next

The prices of properties appear to have stabilised, and we are observing that homes sold 12-18 months ago are now being sold at similar or higher prices compared to their last transaction.

Buyers are still active in the market, although they are exercising caution. People now understand the need to consider potential interest rate increases, so they may not be borrowing to their maximum capacity. However, the level of activity and the willingness of buyers to make transactions have not decreased.

We anticipate a busier than usual spring selling season since many people believe the market situation is improving and inventory levels are returning to normal.

A greater number of Australians are currently residing in apartments than ever before due to factors such as affordability, livability, convenience, and sustainability. Based on this ongoing trend, the unit market is projected to continue growing.

Interested in getting into the property market? Get in touch with our property consultant experts at (02) 9099 3412 or enquire below.