As we move into 2025, the Australian property market is undergoing key shifts influenced by economic indicators like the Consumer Price Index (CPI). Understanding these changes is crucial for individual property buyers and investors looking to build long-term wealth through real estate.

Table of Contents

Understanding the Current Consumer Price Index in Australia

The Consumer Price Index (CPI) serves as a key measure of inflation, reflecting shifts in the cost of living. As of December 2024, Australia’s annual CPI growth was 2.4%, slightly lower than the 2.8% recorded in the previous quarter. This downward trend signals a more stable economic environment, creating favourable conditions for property investors and first-time homebuyers.

According to Michelle Marquardt, Head of Prices Statistics at the Australian Bureau of Statistics (ABS), the 0.2% CPI rise in December 2024 mirrors the increase recorded in September 2024. Such modest changes mark the lowest CPI growth rate since June 2020, when the market was impacted by COVID-19 policies, including free childcare.

Housing Market Influence on CPI Trends in 2025

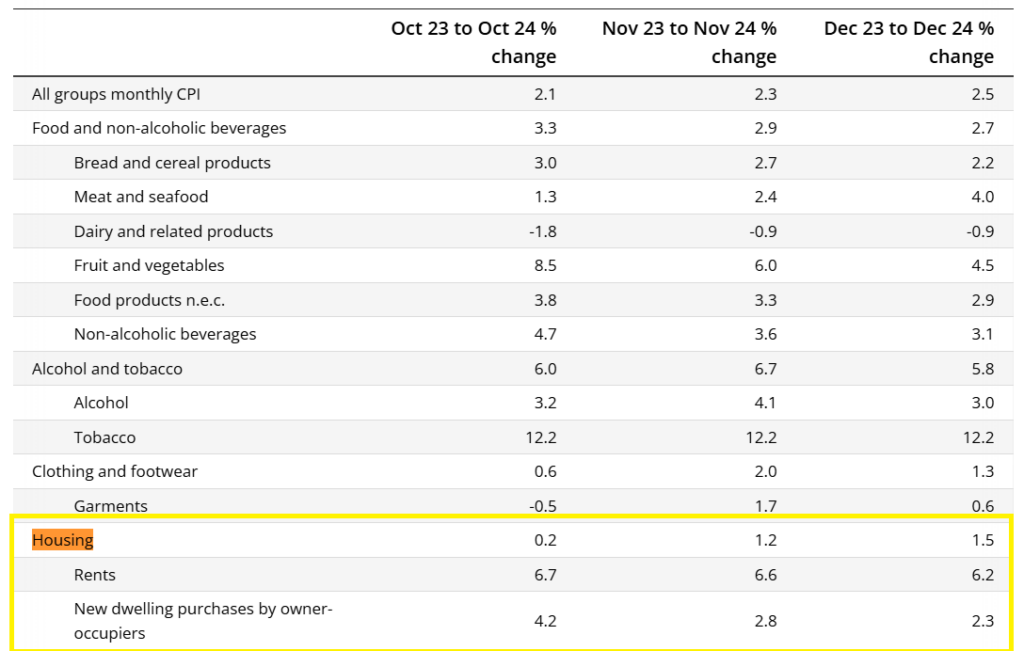

Between October 2023 and December 2024, the housing sector significantly influenced CPI trends:

- October 2023 – October 2024: CPI rose by 0.2%

- November 2023 – November 2024: CPI increased to 1.2%

- December 2023 – December 2024: CPI further climbed to 1.5%

These figures indicate a continued demand for housing, reinforcing the resilience of the real estate sector in Australia.

Key Factors Driving CPI Movement in Australia

The real estate sector remains a major contributor to CPI fluctuations, with housing costs climbing 1.5% annually. This increase highlights a strong property market, where demand for residential and investment properties remains high.

The price of new dwellings or newly built homes for owner-occupiers declined by 0.2%, marking the first drop in this category since the June 2021 quarter. This decrease was largely influenced by project home builders offering increased incentives and promotional deals to attract buyers, counteracting price hikes from some builders due to rising labour costs. On an annual basis, new dwelling prices saw a 2.9% increase, representing the slowest annual growth since June 2021.

For property investors, the rising CPI in housing signals an opportunity for long-term capital growth, as property values and rental yields continue their upward trajectory. The consistent demand for housing, combined with Australia’s growing population, further cements property investment as a wealth-building strategy.

A Promising Landscape for Property Investors in 2025

The latest CPI data suggests a strong property market outlook for 2025. With housing prices steadily increasing, investors can expect higher capital gains and rental yield growth.

Why This Matters for Property Investors:

Stable Inflation Supports Market Predictability – Lower inflation rates reduce economic volatility, allowing investors to make informed decisions.

Capital Growth Potential – Rising property values offer strong opportunities for long-term investment growth.

High Rental Demand – Increasing rental prices contribute to improved rental yields, making property investment more lucrative.

New Dwelling Price Trends – Although new dwelling prices declined by 0.2% in December 2024, marking the first drop since June 2021, demand for housing remains strong, presenting opportunities for strategic acquisitions.

With Australia’s population growth driven by immigration and urbanisation, demand for housing will continue rising. Investors who position themselves strategically in emerging and high-growth suburbs stand to benefit significantly.

Key Strategies for First-Time Property Buyers and Investors in 2025

For those entering the real estate market, understanding the impact of CPI changes is essential for making informed decisions. Here are key strategies to consider:

1. Research High-Growth Suburbs

Identifying suburbs with strong capital growth potential can maximise investment returns. Areas undergoing infrastructure development and population expansion are prime targets for investment.

2. Prioritise Sustainable Investments

Properties with energy-efficient features are increasingly popular among buyers and renters. Investing in eco-friendly homes not only attracts higher demand but also ensures long-term value appreciation.

3. Leverage Financial Opportunities

With interest rates stabilising and potential rate cuts on the horizon, now is an ideal time to explore financing options. Securing competitive loan terms can enhance purchasing power and investment potential.

4. Diversify Investment Portfolios

Investing across different property types and locations can help mitigate risks and maximise returns. Considering regional areas with high rental demand can also be a strategic move.

Want to start with your first investment property in Australia? Find out our latest investment properties.

CPI Trends and the Future of Property Investment in Australia

As we navigate 2025, keeping a close eye on CPI trends will be essential for both seasoned property investors and first-time buyers. The combination of rising housing costs, moderating inflation, and sustained demand presents a strong case for strategic property investment.

Understanding how the Consumer Price Index impacts property values, rental yields, and investment opportunities will allow buyers and investors to make well-informed decisions, securing long-term financial growth in Australia’s dynamic real estate market.

Frequently Asked Questions (FAQs)

1. What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) measures the average change in the prices of goods and services purchased by households, reflecting inflation and the cost of living in Australia.

2. How does CPI affect the property market?

CPI influences interest rates, housing demand, and property prices. A rising CPI can lead to higher mortgage rates, while a stable CPI supports a predictable investment environment.

3. Is 2025 a good time to invest in Australian property?

Absolutely yes. With moderating inflation, rising rental yields, and sustained demand for housing, 2025 presents strong investment opportunities for both first-time buyers and experienced investors.