The Federal Budget 2025 has unveiled a series of significant measures aimed at addressing Australian housing affordability crisis. With a primary focus on first home buyers and increased housing supply, the Albanese government has allocated $858.8 million in new funding to address Australia’s housing challenges in the Federal Budget 2025, despite highlighting a $33 billion investment in housing since coming to power.

One of the most promising aspects of this year’s budget for home buyers is the revised inflation outlook, which suggests Australia’s inflation battle will be resolved six months earlier than previously expected. This positive shift could provide much-needed relief for home buyers, paving the way for improved Australian housing affordability and greater access to homeownership opportunities.

However, while first-home buyers stand to benefit the most, broader issues such as rising home prices, mortgage repayments, and rental affordability remain critical concerns for investors and homeowners alike.

Table of Contents

Federal Budget Australia 2025: A Game-Changer for First-Home Buyers?

One of the standout announcements in the budget is the additional $800 million investment into the Help to Buy shared equity scheme, increasing the overall funding to $6.3 billion. This program aims to assist first-home buyers by allowing them to purchase a property with the government co-owning a portion of the house.

Key changes include:

- Income cap increases: The eligibility threshold has risen from $90,000 to $100,000 for individuals and from $120,000 to $160,000 for joint applicants and single parents.

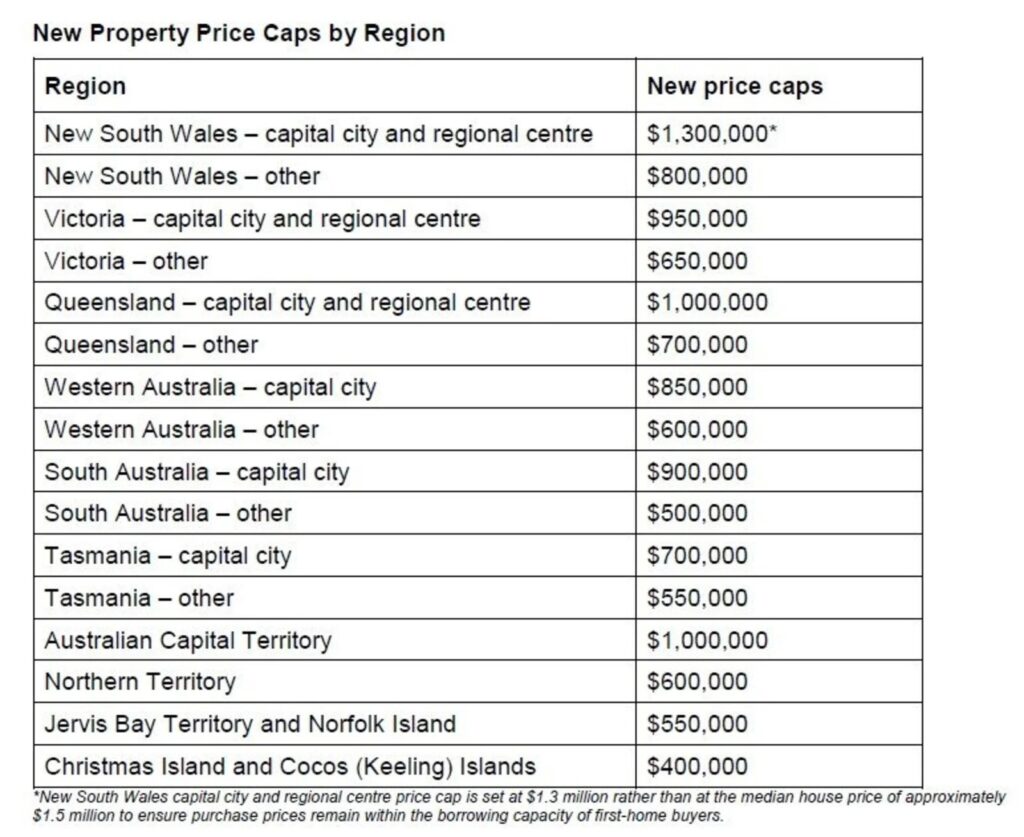

- Higher property price caps: providing first time home buyers with greater flexibility in choosing a home.

According to REA Group executive manager of economics Angus Moore, these changes will broaden access to the affordable housing scheme, making homeownership more achievable for a larger pool of first-time buyers. However, investors and market analysts remain cautious about its actual impact on property prices, especially given that the scheme is contingent on the Albanese government’s re-election.

Home Building: Boosting Supply Through Prefabrication

To tackle Australian housing crisis, the budget has allocated $54 million towards the prefabricated and modular housing sector. This includes:

- $49.3 million to state and territory governments to expand prefabrication capabilities.

- $4.7 million for a voluntary national certification process to accelerate offsite construction approvals.

Housing Minister Clare O’Neil highlighted that prefabricated construction could cut building times by up to 50%, which is crucial for meeting the government’s target of delivering 1.2 million new homes over the next five years.

Despite these investments, housing approvals and supply remain below historical averages, raising concerns about whether these targets can realistically be met.

Following the federal budget 2025, the new price caps by different australian regions have been provided in the chart below.

Source: realestate.com.au

Homeowners and Renters: Cost-of-Living Relief But No Direct Housing Assistance

While the budget lacks direct housing support for existing homeowners and renters, several cost-of-living measures could indirectly ease financial pressures:

- Tax cuts: The 16% income tax rate (for those earning between $18,201 and $45,000) will be reduced to 15% from July 2026 and further to 14% in 2027. This will provide an annual tax saving of $268 in 2026 and $536 in 2027 for taxpayers earning above $45,000.

- Energy bill relief: Households will receive a $150 reduction on power bills under a $1.8 billion rebate program.

- Healthcare investment: The government has pledged $8.5 billion towards bulk-billing incentives for GPs, along with $689 million to lower the cost of medicines under the Pharmaceutical Benefits Scheme (PBS).

- Student debt relief: A 20% reduction in student debt and an increase in the repayment threshold for graduates will provide additional financial relief.

Read More: The Impact of Consumer Price Index Changes on Property Investment in Australia 2025

What Does This Mean for Property Investors in Australia

For property investors, the 2025 budget does not introduce any direct incentives or tax reforms specific to investment properties. However, several key takeaways are worth noting:

- First-home buyer incentives may drive demand in entry-level markets, potentially pushing up prices in suburban and regional areas.

- The prefabricated housing initiative could impact construction costs and timelines, influencing new developments and project feasibility.

- Cost-of-living measures may improve rental affordability for tenants, indirectly benefiting landlords by reducing rental arrears and increasing demand.

A Deficit-Funded Housing Strategy

Despite these housing initiatives, the Albanese government is forecasting a $27.6 billion deficit for this financial year, expected to widen to $42.1 billion next year. This raises questions about the sustainability of continued housing spending, especially in an environment of high inflation and interest rate pressures.

Final Thoughts

While the 2025 Federal Budget introduces significant measures for first-home buyers and home construction, the broader challenges of rising house prices, rental shortages, and affordability constraints remain. For property investors, understanding how these changes impact market dynamics is crucial in navigating the evolving real estate landscape.

Investors should closely monitor the implementation of these policies and consider strategic investment opportunities in markets benefiting from increased first-home buyer activity and government-backed construction initiatives.