Owning investment properties comes with a fantastic perk – there are a variety of rental expenses you can claim to reduce your annual tax bill.

Maximising your deductions can impact your returns and increase your cash flow. This article will explore the top rental expenses that property investors can claim, helping you to boost your tax return.

Here are three rental expense categories:

Table of Contents

1. Rental expenses you can claim now

Common Rental Expenses

In the income year, when you spend money on managing and maintaining your rental property, there are several rental expenses that you can claim as a tax deduction.

Examples of such rental expenses that you may be eligible to claim as an immediate deduction include:

- advertising for tenants

- body corporate fees and charges

- council rates

- water charges

- land tax

- cleaning

- gardening and lawn mowing

- pest control

- insurance (building, contents, public liability, loss of rent)

- pre-paid expenses

- property agent’s fees and commission

- repairs and maintenance

- legal expenses

Interest expenses

One of the most common and biggest rental expenses you can claim a deduction for is the interest element of your mortgage.

However, there is a lesser-known fact that many people are unaware of: besides the mortgage loan used to purchase your rental property, there are other types of rental expenses that you can claim as deductions if they are associated with your rental property.

In fact, you can potentially claim deductions for the interest charges incurred on the loan under the following circumstances:

- Purchasing a rental property

- Acquiring a depreciating asset specifically for the rental property

- Undertaking repairs on the rental property, such as fixing a damaged wall

- Financing renovations or extensions on the rental property currently or intended to be rented out

For more information about interest expenses, download the government’s handy guide here.

2. Rental expenses you can claim over several years

Borrowing expenses

Borrowing expenses refer to the costs of taking out a loan to buy a property.

You can claim a deduction for all qualifying borrowing expenses over 5 years or spread them out over the loan’s term, depending on which option is shorter. However, if the total amount of deductible borrowing expenses is $100 or less, they can be fully deducted in the same income year they are incurred.

You can claim a deduction for the following as borrowing expenses:

- Loan establishment fees

- Lender’s mortgage insurance

- Title search fees charged by your lender

- Costs for preparing and filing mortgage documents (including solicitors’ fees)

- Mortgage broker fees

- Fees for a valuation required for loan approval

- Stamp duty charged on the mortgage.

Capital expenditure

You can claim capital works deductions for the construction of substantial structures associated with your rental property over a specific period of time. These expenses include the costs incurred for the construction of the building, plus structural enhancements and extensions made to the property.

Capital expenditures that you can potentially claim a deduction for over time include:

- Improvements: Capital improvements, including renovations or additions that enhance a property’s value or desirability, such as renovating a bathroom or adding a pergola.

- Initial repairs: Expenses incurred to remedy defects, damage, or deterioration already present at the time of property acquisition.

- Capital works: Expenses incurred in building the property as well as carrying out structural improvements, alterations and extensions to the property.

Depreciating assets

Depreciating assets can be considered as a part of capital expenditure. These are assets with a limited lifespan that can be expected to decrease in value over time as they are used.

If the cost of a depreciating asset exceeds $300, you can claim deductions for its reduction in value throughout its practical lifespan.

Examples of such assets in your rental property include:

- Floating timber flooring

- Carpets

- Curtains

- Appliances like a washing machine or fridge

- Furniture.

Find out more information about depreciating assets here.

3. Rental expenses you cannot claim

In addition to the expenses that can be claimed, it is crucial to be aware of the costs that are not eligible for tax deductions.

As per the Australian Taxation Office (ATO), there are certain expenses related to investment properties that are not eligible to be claimed as tax deductions. These include:

- Borrowing expenses used for private purposes: Any portion of a loan utilised for personal expenses cannot be claimed as a deduction.

- Repayments of loan principal: The amount paid towards reducing the loan balance, known as principal repayments, is not eligible for tax deduction.

- Legal expenses for property purchase: Capital expenses like solicitors’ and conveyancers’ fees incurred during the property acquisition are not deductible.

- Stamp duty on property transfer: The stamp duty imposed by the state or territory government during the transfer or purchase of the property title is considered a capital expense and is not deductible.

- Other expenses related to property transactions.

Additionally, while travel expenses for inspecting your rental property used to be deductible in the past, they are no longer eligible to be claimed as tax deductions.

Tax Return Process for Investment Properties

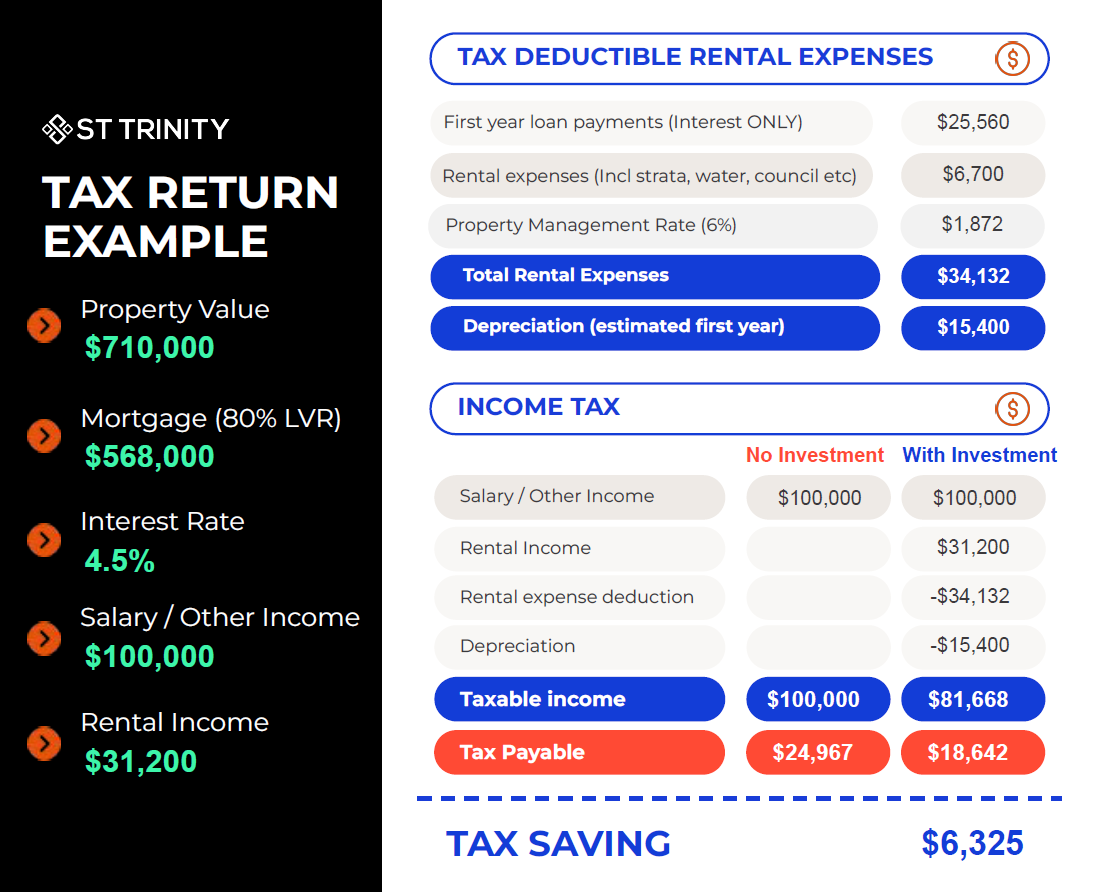

To simplify the process of understanding how you can save on taxes, let’s have a look at the following example:

Disclaimer: Estimated figures are provided by the strata manager & property manager for a 2-bedroom apartment in Kogarah and should be used for general information only. You should consider seeking independent legal, financial, taxation or other advice to check how the information relates to your unique circumstances.

Bottom Line

By effectively leveraging the significant tax advantages tied to property investment, you have the potential to enhance your tax refund and optimise your overall financial position. As the financial year draws to a close, seeking guidance from experienced property or wealth consultants who can offer valuable insights and customised strategies tailored to your tax return requirements becomes increasingly vital.

Take control of your financial future by contacting our team of professionals today.

Contact us at (02) 9099 3412 or submit an enquiry below.

FAQs

How do I maximise my tax return on an investment property?

To maximise your investment property tax deductions, follow these six easy steps:

-

Know What Rental Expenses You Can Claim: Familiarize yourself with the rental expenses you can claim, such as mortgage interest, property management fees, insurance, repairs, and maintenance costs.

-

Know What Rental Expenses You Cannot Claim: Equally important is understanding the expenses that are not deductible, like personal expenses or capital costs. Being aware of these distinctions helps you avoid claiming ineligible deductions.

-

Keep Records of Your Rental Expenses: Maintain thorough and organized records of all your rental-related income and expenses. Proper documentation is crucial for substantiating your deductions during tax filing.

-

Take Advantage of Depreciation Deductions: Investigate the depreciation benefits you can claim for both the property and its assets. Engage a quantity surveyor or tax professional to help you assess and maximize your depreciation deductions.

-

Offset Your Taxable Income with Claimable Rental Expenses: If your property generates a net loss, you can often offset this loss against your other taxable income, reducing your overall tax liability. Ensure you are leveraging this advantage effectively.

-

Don’t Forget About Capital Gains Tax: While focusing on deductions, also keep the potential capital gains tax in mind. Consult with a tax professional to understand how selling your investment property might affect your tax situation and plan accordingly.