In this Property Market Update December 2023, we will discover some key insights:

- Sydney leads the national property market rebound, with home values surpassing their previous peak.

- China drives a surge in foreign investment in the Australian property market, fueled by post-pandemic reopening and record migration.

- Queensland doubles the First Home Buyer Grant to $30,000 until mid-2025 to aid homebuyers.

- Major investments reshape regional landscapes across Australia, with developments in entertainment venues, sports complexes, and infrastructure.

- Investors are drawn to regional markets with soaring property values, indicating a shift towards remote investing for better capital growth prospects and higher rental yields.

Table of Contents

RBA Cash Rate Update

The Reserve Bank of Australia (RBA) has decided to leave the cash rate target unchanged at 4.35 per cent.

There won’t be any more interest rate increases for at least the next two months, which is the Christmas present that so many homes and businesses have been waiting for.

The decision was made in response to recent data that showed inflation is moderating, but services inflation remains persistent. The RBA is concerned about the risk of inflation remaining higher for longer and is prepared to raise interest rates further if necessary.

Here are some key points from the article:

- The RBA’s priority is to return inflation to target within a reasonable timeframe.

- High inflation is weighing on people’s real incomes and household consumption growth.

- Higher interest rates are working to establish a more sustainable balance between aggregate supply and demand in the economy.

- The RBA remains resolute in its determination to return inflation to target and will do what is necessary to achieve that outcome.

Sydney’s Property Market Leading National Recovery

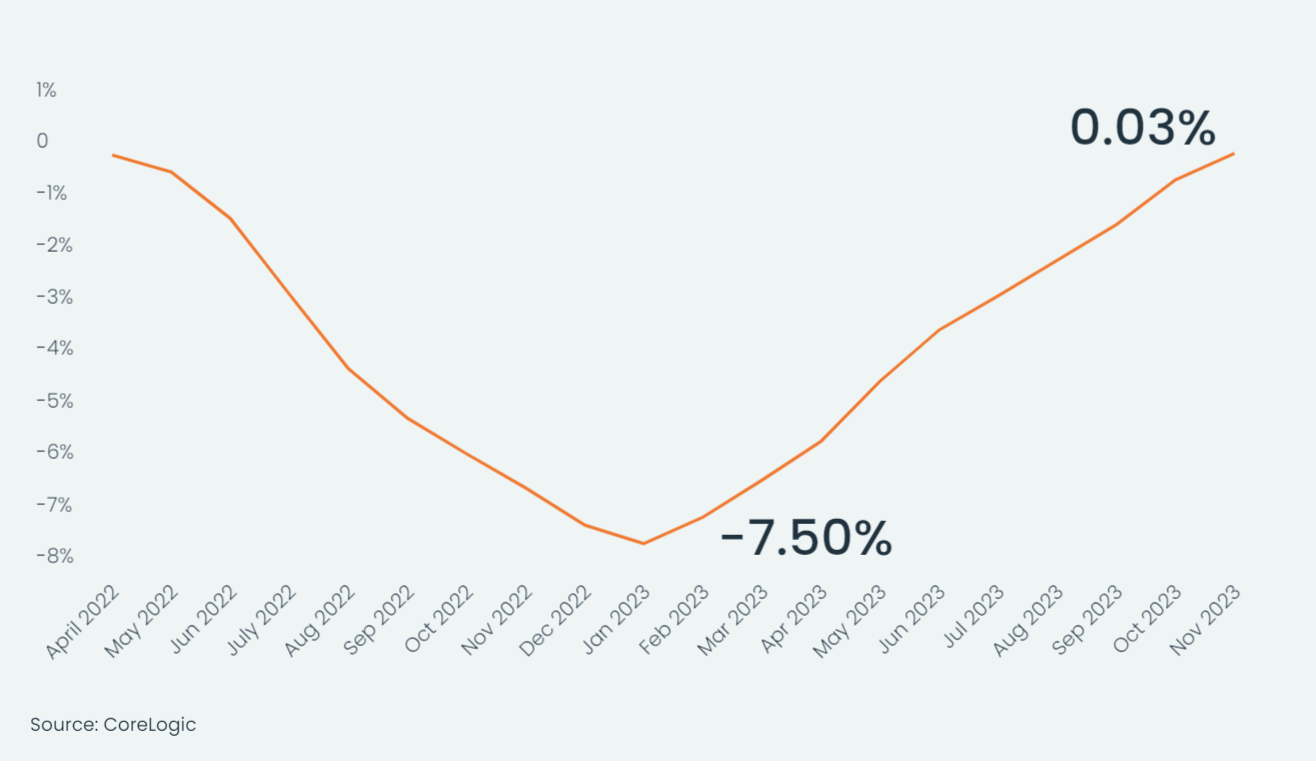

Home values across the country hit a record high in April 2022 but dropped by -7.5%, hitting the lowest on January 29, 2023. Since hitting that low, the national Home Value Index (HVI) has increased by 8.1%, reaching a new all-time high on Wednesday, November 22, 2023.

Australian home values have not only bounced back from a recent dip but have reached a new record, as per CoreLogic’s national daily HVI.

However, if we look closer, the housing market isn’t consistent across the country. Cities like Perth, Adelaide, and Brisbane, along with their regional areas, are experiencing unprecedented success and have also hit record highs.

But in Hobart, home values are still 11.8% lower than their peak, and in Regional Victoria, they’re 7.0% below the highest point.

Change in national home values from April 2022 peak

Sydney is leading the national property market recovery, with home values returning to their long-term growth trend after a brief and sharp correction.

According to this year’s McGrath Report, Sydney bounced back earlier than anticipated, despite rising interest rates.

The limited housing supply led to a rapid and sustained price increase, with auction clearance rates exceeding 70%.

A rise in migration, especially from China, has boosted demand in Sydney’s market. Migrants typically rent initially, but with low vacancy rates in Sydney, newcomers are likely hastening their first home purchases.

Inner and middle-ring suburbs are experiencing the fastest price growth as buyers aim to upgrade in premium neighbourhoods.

The most significant price recovery is observed in Sydney’s prestige market, driven by a weaker Australian dollar attracting expats and foreign buyers to prestigious homes in harbour and beach areas.

In May 2023, a record-breaking $45 million sale occurred in Tamarama on Sydney’s eastern beaches.

Source: AFR – Artist’s impression of the DA-approved design for the contemporary Tamarama home comes with a pool and wellness centre.

Migration from Sydney to regional areas continues, but not as much as during the pandemic.

Currently, Sydney is re-entering a phase of normal market conditions, where 2% to 5% growth per year is a reasonable expectation.

China’s Property Investment Surge in Australia: A Deep Dive

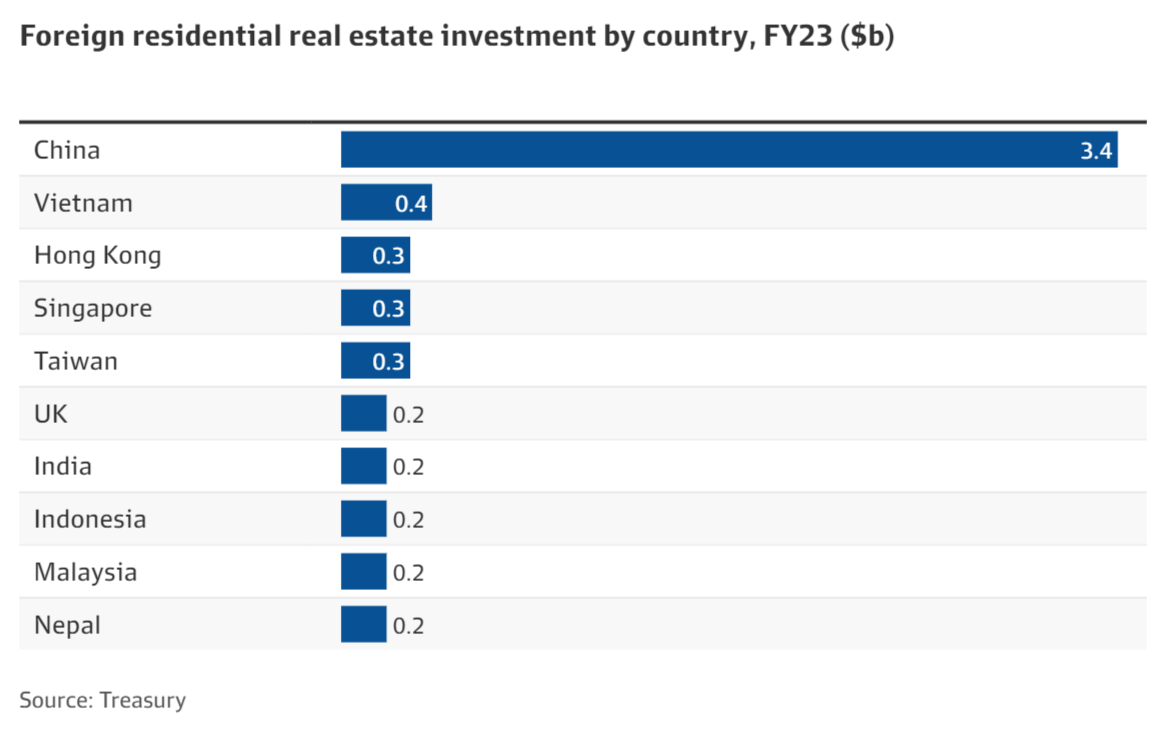

China is spearheading a significant surge in foreign investment in the Australian property market, driven by record migration and the country’s post-pandemic reopening.

As international agents report a staggering 400% increase in inquiries, several key trends and factors are reshaping the landscape of Australian real estate.

Chinese Dominance in Key Markets

Treasury data indicates a substantial influx of overseas buyers into Sydney, Melbourne, and Brisbane, with a notable 40% increase in government approvals over the past quarter compared to the previous year.

Mainland China, Hong Kong, Taiwan, and Vietnam are leading this surge, marking a resurgence in foreign interest.

Impact on Australian Home Prices and Supply

Real estate professionals surveyed in NAB’s residential property survey estimate a consecutive increase in the share of total market sales to foreign buyers, reaching a 5½-year high.

While CoreLogic’s Eliza Owen suggests that increased foreign interest may push up prices for Australian home buyers, the potential impact could be offset by an expected rise in supply.

Ms Owen points out that rising foreign investor interest often stimulates more supply, theoretically mitigating significant impacts on prices in an unconstrained supply environment.

Changing Preferences of Chinese Buyers

Chinese buyers are not only returning to the Australian property market but are also eyeing more expensive properties.

Data from the Juwai IQI group reveals that inquiries now focus on properties with median prices over 25% higher than those in 2019.

Peter Li, general manager of Plus Agency, notes a substantial increase in buyer inquiries, driven primarily by Hong Kong-based buyers, mainlanders, and Taiwanese.

The trend indicates a growing preference for larger properties, with most buyers aged between 35 and 45. These properties are often seen as “transitional homes,” where buyers plan to reside for the next five to ten years before seeking larger properties.

As China’s post-COVID reopening accelerates and Australia experiences record annual net overseas migration numbers, the surge in international buying is expected to continue.

The removal of COVID test requirements for travel from China adds to the ease of accessing the Australian property market, especially as the real estate market in China experiences a downturn.

While Chinese buyers are historically known for investing in Australia to diversify their assets, there’s a shift towards purchasing family homes for full-time residents. This signified a change in investments compared to the mid-2010s when Chinese interest in Australian residential property peaked.

The resurgence of Chinese interest in the Australian property market brings both opportunities and challenges.

As international buyers seek premium alternatives abroad, the impact on local home prices and the housing market’s overall dynamics will be closely watched.

Booming Regional Growth and Positive Investor Sentiment

Thriving Regional Development Infrastructure

Exciting developments are reshaping regional landscapes across Australia as major investments pour into various sectors.

Aura Hotel – Sunshine Coast’s largest entertainment venue

- Comiskey Group invests $35 million in Sunshine Coast’s largest music venue at Aura development, opening in 2024 for 2,500 people with restaurants, bars, and function spaces.

- NSW plans a $35 million sports complex at Orange Ex-Services Country Club for rugby league, union, football, AFL, and cricket, fostering emerging talent.

- NSW Government allocates nearly $60 million to enhance racing infrastructure in Scone, Gosford, and Cessnock.

- Victoria’s $4 billion investment in Regional Rail Revival upgrades every regional passenger train line.

- $46.8 million Surf Coast Aquatic and Health Centre opens in Torquay, contributing to Victoria’s regional transformation.

- Tasmania’s Living City project revitalizes Devonport with a $55 million waterfront precinct, including a hotel, amphitheatre, events common, parks, playgrounds, and pathways, featuring a nightly sound and light show.

As regional Australia thrives, the work-from-home trend opens new possibilities for a better life outside major cities. With property prices and rents stabilising, the momentum is set to continue, offering a promising future for those seeking a vibrant regional lifestyle.

Investors Flocking To Regional Areas

There’s been a significant shift in how Australians think about where to live. Many city dwellers, who had never really considered moving to regional areas before, suddenly embraced the idea in large numbers.

Motivated by the prospect of getting more value for their money and enjoying flexible work arrangements introduced during the COVID-19 pandemic, people left the cities in large numbers. Initially seen in those seeking a sea or tree change, this trend was amplified by what demographer Bernard Salt dubbed VESPAs – Virus Escapees Seeking Provincial Australia.

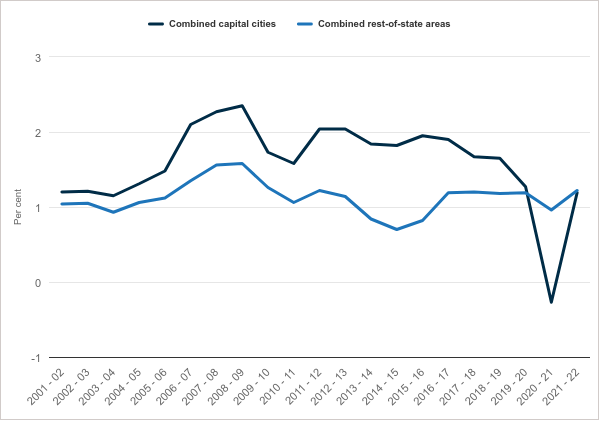

As highlighted in this year’s McGrath Report, the population of regional Australia increased by over 100,000 in FY22, the largest increase since 2009. This influx has profoundly impacted regional areas, leading to unprecedented job growth, increased investment, improved services, and better infrastructure, ultimately enhancing the overall quality of life.

Combined capital city and rest of state growth, 2001-02 to 2021-22

Source: ABS

Property values in these regions also soared, making it an appealing market for investors.

According to data from MCG Quantity Surveyors, the average distance between where property owners live and where they invest has reportedly increased to 857km, compared to 559km in the year to November 2021 and 294km before the pandemic.

This suggests that investors are exploring opportunities further away, especially in regional areas.

The shift towards remote investing is mainly driven by the perception of better capital growth prospects in regional areas and higher rental yields associated with more affordable properties.

Queensland Doubles First Home Buyer Grant: A Closer Look

The Queensland government’s recent announcement to double the First Home Buyer Grant from $15,000 to $30,000 has sparked both excitement and debate.

This boost, effective from November 20th and lasting until mid-2025, aims to assist individuals in purchasing or constructing a new home valued at less than $750,000, including options like granny flats and relocated homes.

The increased grant will substantially boost First-home buyers’ purchasing power, making it easier for them to save for a deposit and bridge the gap between their savings and the purchase price of a home.

Snapshot of Queensland’s Housing Landscape

As of August, the median price of a new house in Brisbane stood at $717,000, while the median price of a new unit was $590,000.

Regional Queensland exhibited variations, with median house prices ranging from $288,000 at Mount Isa to $909,000 on the Sunshine Coast and median unit prices from $277,000 at Yeppoon to $686,000 on the Gold Coast/Tweed Heads.

Source: World Travel Guide

Despite a 21.4% increase in household incomes over the five years leading up to September 2023, housing values in the state surged by 50.1% during the same period.

From a supply perspective, dwelling commencements are tracking 16.5% below the ten-year average, and the pipeline of approved supply is approximately 18% below the decade average.

Notably, first-home buyers constitute 26.3% of owner-occupier mortgage demand across Queensland, ranking it as the second lowest among states after NSW.

2024 Property Outlook: Brisbane and Perth Lead the Way in Price Growth

The Australian property market could be in for a mixed year in 2024, with new research anticipating moderate price falls in some of the country’s largest cities.

Average national dwelling prices are predicted to shift from -1 % to 3% next year, according to the base forecast outlined in SQM Research’s 2024 Housing Boom and Bust Report.

Louis Christopher, managing director of SQM Research, says that Brisbane and Perth are likely to be the only capital cities that will record meaningful rates of price growth, though property prices in other cities are likely to stay relatively flat or trend downwards.

As property experts are keen to emphasise, the diversity of Australia’s housing markets means it’s worth looking regionally rather than nationally.

“Perth and Brisbane are still very likely to record price rises based on super tight rental conditions, a better-than-expected global commodities market and minimal exposure to the financial services sector,” says Christopher.

More Homes Are Cheaper to Buy Than Rent, Despite Rising Costs

Deciding between buying and renting a home, especially for first-time buyers, can be a tricky puzzle involving various financial and emotional factors. A recent in-depth study by PropTrack delves into the financial aspects and reveals that over a third of homes across the country are actually more affordable to buy than rent.

Even with the recent surge in interest rates, making homeownership more expensive, the analysis indicates that buying remains a cost-effective option for a significant portion of the housing market. Currently, the average new mortgage rates for homeowners have surpassed 6%, marking the steepest increase on record. Meanwhile, rents have also climbed substantially, showing a 14.6% increase over the past year.

The analysis uncovers interesting regional variations. In New South Wales and Victoria, where home prices are generally higher, less than a quarter of homes are found to be cheaper to buy than rent. However, in Western Australia, over three-quarters of homes are more affordable to buy, presenting favourable conditions for potential buyers.

Interestingly, the study highlights that units are generally more budget-friendly to buy than houses. Across the country, 55% of units are cheaper to buy than rent, compared to only 29% of houses. Even in cities like Sydney and Melbourne, where houses are less likely to be affordable, there are opportunities for buyers in the unit market.

The analysis emphasizes that the outcome depends on how prices and rents change over time. It comprehensively compares the expected total financial costs of buying and renting, considering factors such as mortgage rates, stamp duty, maintenance costs, and more.

The numbers are based on PropTrack’s estimates of current prices and rental costs across Australia, projecting the total cost of owning and renting each home over the next 10 years.

It’s clear that despite the complexities, there are still good buying opportunities in various parts of the country, and the decision between buying and renting will ultimately hinge on individual circumstances and market trends.

Property Market Update December 2023: Summary

In summary, Australia’s property market is undergoing many changes.

More Chinese are making real estate investments, which have positive and negative effects. Queensland has decided to increase first-time homebuyer grants, but it is still debatable whether this will ultimately result in more affordable homes.

In regional towns and areas outside big cities, exciting new projects and investments are taking place, making it a good choice for both owner occupiers and property investors.

The shift towards remote investing underscores a changing paradigm as investors recognise regional areas’ appeal for capital growth and higher rental yields. As the property market keeps changing, it’s important for investors to think carefully about what’s happening in different parts of the country to ensure making the right investment decision.

Stay ahead of market trends and gain invaluable insights by contacting our team of experts.

Contact us today to ensure you’re well-informed, strategically positioned, and equipped with the knowledge to make informed decisions in Australia’s dynamic property market.

Seize the opportunity to invest in property before 2023 comes to an end!