In this Australian Property Market Wrap Up 2023, the Australian property market displayed remarkable resilience in facing challenges, including rising interest rates and escalating inflation. Contrary to expectations, the market exhibited strength and adaptability, setting the stage for a promising trajectory into 2024.

As we approach the concluding chapter of 2023, let’s take a moment to reflect on the events and trends that have shaped this year.

Table of Contents

The RBA’s Monetary Policy Tightening Cycle in 2023

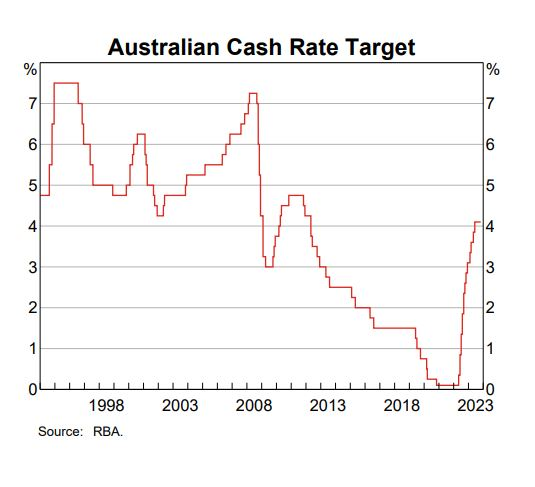

The Reserve Bank of Australia (RBA) raised the cash rate five times in 2023, with the most recent increase occurring on 7 November 2023. The total cumulative increase in the cash rate for 2023 is 1.25 percentage points.

Although the overall increase in cash rate for 2023 is lower than that in 2022, 1.25 compared to 3 basis points, The RBA is expected to continue raising the cash rate in 2024 at a continued slower pace. The RBA’s goal is to return inflation to its target of 2-3%, and it is willing to raise interest rates to achieve this goal.

To counter these inflationary pressures, the RBA took modest action by raising the official cash rate (OCR) at just five meetings in 2023. This decisive move elevated the OCR from 3.10% at the start of 2023 to 4.35% in November, constituting the fastest and most aggressive tightening cycle in recent history, including the eight rises in 2022.

The RBA has warned of another possible increase to the OCR in its quarterly Statement on Monetary Policy.

Following the increase in the cash rate target by 25 basis points to 4.35% in November, the RBA said market pricing implied an “expectation that the cash rate may be increased once more in the first part of 2024”.

Looking at the numbers, mortgage holders endured 13 rate hikes over the past 18 months, including five in 2023, raising the cash rate from 0.1% to 4.35%.

There were concerns about a “fixed-rate cliff,” but Domain’s report found that the transition off fixed rates didn’t lead to a surge in distressed listings.

The RBA will keep a close eye on inflation and how well the economy is doing to decide what to do next.

Big Four Banks’ Cash Rate Forecasts

The four major banks in Australia have released their predictions for the cash rate over the next few years. Here is a summary of their forecasts:

- CBA: Peak of 4.35% in November 2023, then dropping to 2.85% by May 2025.

- Westpac: Peak of 4.35% in November 2023, then dropping to 2.85% by December 2025.

- NAB: Peak of 4.60% by February 2024, then dropping to 3.10% by February 2026.

- ANZ: Peak of 4.35% in November 2023, then dropping to 3.35% by June 2025.

Bear in mind that these are mere predictions, and the major banks may alter these forecasts.

Property Market Wrap Up: A Recap of 2023

House Price Increase Amidst Interest Rate Challenges

2023 was a puzzling year for Australia’s housing market. Instead of going down as predicted, prices increased, leaving us wondering what 2024 has in store.

At the start of the year, experts thought interest rates would rise, and house prices would drop. But surprise, surprise – the opposite happened.

Despite higher interest rates, inflation, and a bit of a gloomy mood among buyers, house prices soared. The median house price for all capital cities hit a new high at $1,084,855, and regional areas reached $591,139.

Prospective sellers were understandably cautious in the first half of this year, holding back on listing their homes for sale, but that scarcity of new listings fuelled buyer competition.

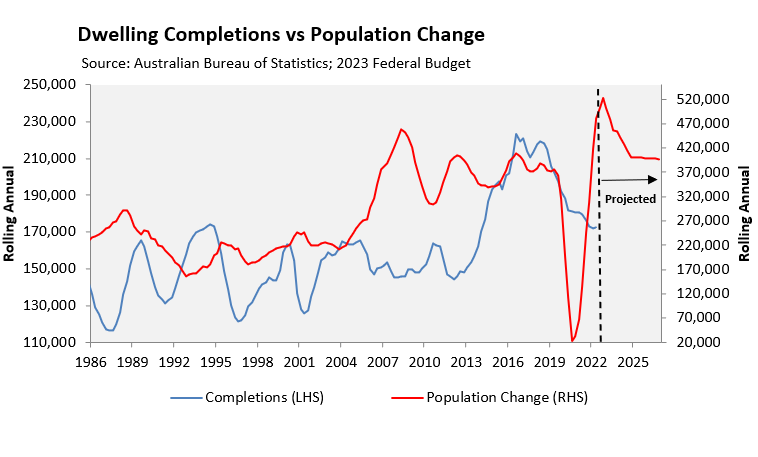

Unprecedented population growth following the pandemic, low unemployment and the extraordinarily tight rental market meant there were more buyers than sellers in the market. And so property prices went up.

Then, motivated by the price recovery and the belief that interest rates were close to their peak, sellers regained confidence.

Winter became the new spring, with an influx of properties hitting the market at a traditionally quiet time. Domain’s report showed that new listings surged above the five-year average in August, especially in Melbourne and Sydney.

Despite the rise in listings, prices have increased since then, just not as quickly. But they are still increasing.

Domain’s report revealed Australia ends 2023 with house prices largely recovered.

- Brisbane has fully recovered from the downturn;

- Sydney house prices have only $7000 left to break through to a new price record;

- Melbourne is just 4.1 per cent from its peak,

- Adelaide and Perth, well, they never really suffered a downturn at all.

What caused prices to surge so quickly?

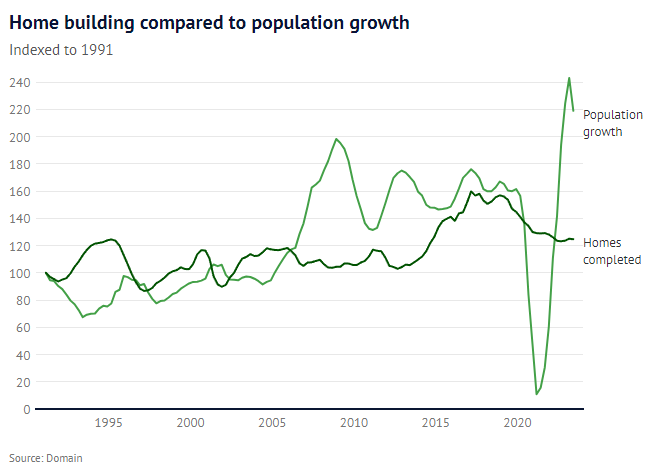

The gap in demand between how many houses we have and how many people want them has been driving up prices. Surprisingly, this trend is expected to continue and put pressure on buyers until 2024.

Despite expectations that house prices would fall with rising interest rates, they’ve actually shot back up, even reaching record highs. This goes against what many experts thought would happen, especially with 13 interest rate increases and a cost of living crisis affecting people’s spending power.

One important factor, according to Powell, was a housing supply shortage that had been building for decades, as new home completions failed to keep pace with population expansion and adapt to the rise in smaller households, both of which drove higher housing demand.

“That existing housing shortfall has collided in 2023 with strong population growth, a constrained construction sector … and the tightest rental market on record,” she said.

Against expectations, property prices rebounded strongly in 2023, even with the increase in interest rates. The high demand for homes, driven by a shortage in housing, outweighed the impact of the rising rates.

While median house prices in Sydney are just below their peak, other cities like Brisbane, Adelaide, Perth, and regional Australia have reached or returned to peak prices. Melbourne, Canberra, Hobart, and Darwin are still down.

Looking ahead, Powell predicts house prices in the combined capital cities to rise another 6% to 8% next year, with regional prices 2% to 5% higher. Sydney is expected to lead with 7% to 9% growth, while Melbourne and Hobart may see softer growth at 2% to 4%.

Housing Industry Association senior economist Tom Devitt finds it remarkable that prices are increasing during the sharpest rate rises in a generation.

He expects more homes to be available for sale as prices increase, which could slow down price growth, but the ongoing gap between supply and demand will likely keep pushing prices up.

2024 Property Market Forecast

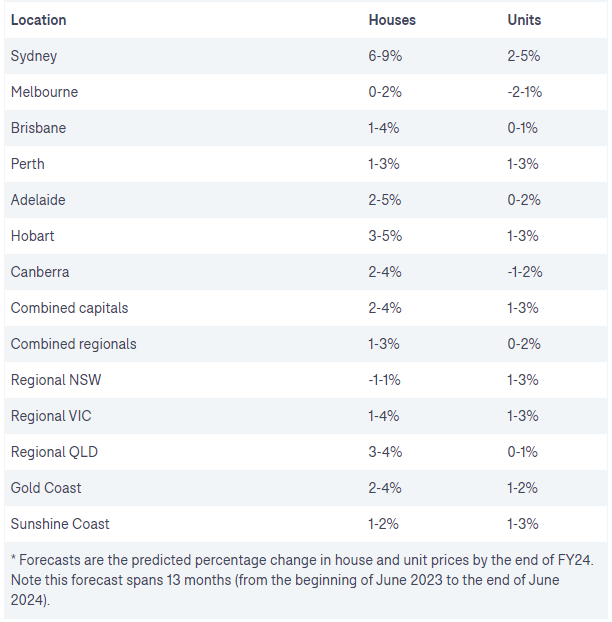

Looking into the upcoming year, Domain’s 2024 Outlook Report foresees continued growth in house and unit prices, a sustained high level of interest rates, and robust population growth.

“We anticipate continued growth in house and unit prices, with some buyers, sellers and renters proactively adapting to the lingering impact of the 2023 market and potential changes in 2024,” Dr Nicola Powell, Domain’s Chief of Research and Economics says.

Here are Domain’s predictions for the property market in 2024.

Source: Domain

According to Domain, the Australian property market presents diverse trends across major cities.

- In Sydney, house prices are poised for a new record high with a forecasted growth of 6% to 9%, surpassing the previous peak.

- Melbourne anticipates stable house prices and potential recovery in units.

- Brisbane is nearing a new record high for houses with a steady recovery, while units are expected to stabilise at a new high.

- The Sunshine Coast and Gold Coast are poised for new record highs

- Regionally, a modest increase in house and unit prices is expected, with a focus on the combined capital for growth.

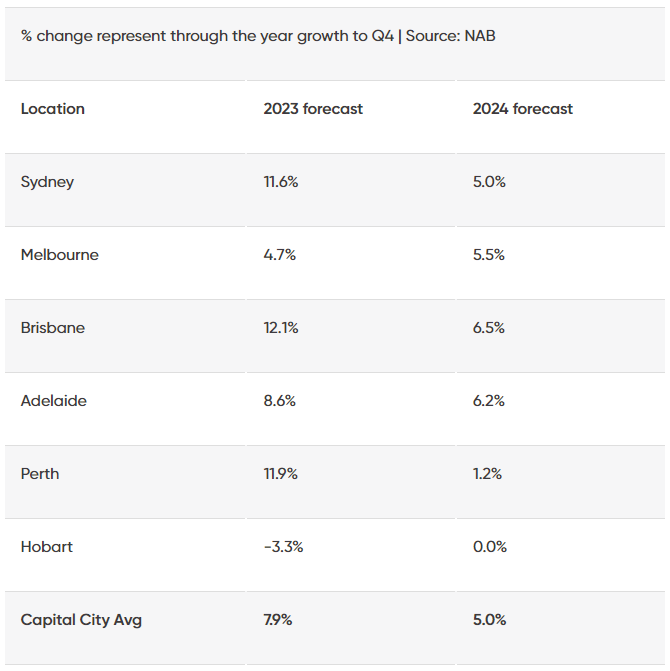

NAB: Property prices tipped to rise 13% by the end of next year

NAB has revised its forecasts for 2023 and 2024 in response to a significant gap between house demand and limited supply. Despite the potential for increasing interest rates, the bank maintains a positive outlook on the property market.

- NAB expects strong price growth across the combined capital cities over this year and next, but the momentum will vary between states.

- Brisbane prices are expected to surge almost 19% over the two years, while Melbourne is expected to be the only capital city to see prices accelerate next year.

- Hobart remains the weakest-performing market, with prices down 6.6% from the March 2022 peak.

NAB chief economist Alan Oster said property prices “continue to be supported by a significant supply-demand imbalance”, despite rising rates and reduced borrowing power.

“For 2024, we expect prices to rise by around 5%, supported by population growth, rental increases, and a resilient job market. However, there might be some pressure from the impact of higher interest rates.” – Oster stated.

These observations align with property price predictions by KMPG, estimating a 15% upturn in house prices by mid-2025 and a surge of over 9% in apartment prices.

KPMG: 15% Soar in Aussie House Prices

Property values nationwide are expected to surge in the next 18 months, as outlined in the September 2023 Residential Property Market Outlook report by KPMG Chief Economist Dr. Brendan Rynne, which identified several factors likely to contribute to the upward trajectory of prices.

“House and unit prices will then accelerate further in the next financial year as dwelling supply continues to be limited, due to scarcity of available land, falling levels of approvals and slower or more costly construction activity.”

KPMG’s latest property report forecasts a national increase in house prices of 4.9% over the next nine months, followed by a substantial surge of 9.4% in the year leading up to June 2025 across Australia’s capital cities.

Source: REA

2024 Property Trends Unpacked

1. Affordability and Demand

The housing market will remain resilient in 2024 despite stretched affordability and declining borrowing power. A potential rate cut or other stimulus measures could reignite demand and trigger another price upswing, particularly in the latter half of the year.

Alternatively, an easing of the mortgage serviceability buffer could boost borrowing capacity and improve the cost of holding debt, leading to increased demand and upward price pressures.

2. Urban Spread and Gentrification

As affordability constraints persist, buyers will continue to explore less popular suburbs and areas they initially overlooked.

This urban spread and the federal government’s ‘Help to Buy’ scheme will likely drive demand for affordable homes, especially units, in larger capitals. Generational inheritance is expected to rise as Baby Boomers consider early inheritance options, influencing buying capacities and choices.

3. Population Growth and Rental Market

Australia’s strong population growth, driven by migration, will continue influencing housing markets into 2024 and beyond. This and a challenging rental market could encourage more people to consider purchasing a home.

Source: Macrobusiness

However, stretched affordability is likely to moderate rent growth and bring more balance to some sub-markets. Renters may opt for house shares, and first-home buyer incentives could help transition some to ownership or accelerate their path to an affordable purchase.

Conclusion

The property market wrap up 2023 uncovers these key insights:

- The Australian housing market experienced a surprising surge in 2023 despite rising interest rates and inflation concerns. Many factors drove this, including a housing shortage, strong population growth, and a tight rental market.

- Looking ahead to 2024, experts predict further price growth and a delicate balance between affordability concerns, policy measures, and demographic trends will shape the housing market in 2024.

- With affordability headwinds potentially tempering demand, potential stimulus measures, urban spread, and population growth could still support market activity.

- The easing of rental pressures could also encourage more renters to consider homeownership.

Don’t miss out on the next property boom!

Overall, the housing market is expected to remain resilient in 2024, with demand and prices continuing to adjust to economic and demographic factors.

Now is the time to talk to us about your property goals. We can help you navigate the changing market and make sure you’re making the right decisions for your future.

Contact us today to find out more.